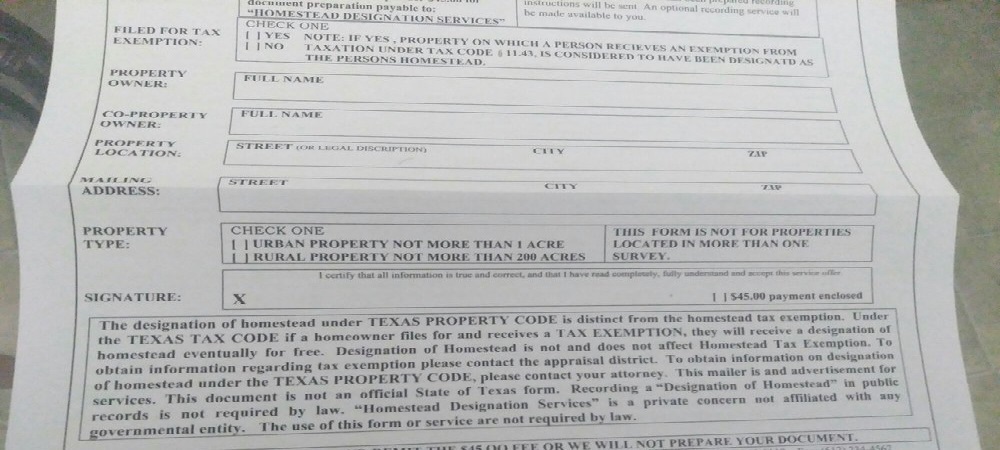

Attorney General Ken Paxton is warning consumers to beware of businesses that are sending misleading letters to Texans offering a "designation of homestead" if they pay a fee of $45 or $49 to help them recover unclaimed government funds if the homeowner signs an agreement giving the solicitor half the recovered money. But, counties make the standard homestead tax exemption available for free to property owners.

Many homeowners complain after being misled by letters from individuals or businesses that offer to help them recover unclaimed government funds if the homeowner signs an agreement giving the solicitor half the recovered money. In the typical case of this type, the homeowner simply receives a property tax homestead exemption application form prepared by the firm doing the solicitation.

Unfortunately, once the homeowner has agreed to pay the solicitor half the refund, he or she loses that much of any potential tax refund, and many of these firms have been quick to sue in small claims court if the unfortunate individual refuses to pay.

To date, the Consumer Protection Division of the attorney general’s office has received more than 100 complaints from individuals who received solicitations for these designations and, in some cases, sent back money for a homestead exemption.

“My office is actively reviewing all of the complaints and we will take whatever legal steps are necessary to stop unlawful activity by any company trying to take advantage of Texans,” Attorney General Paxton said. “I urge anyone who has received a solicitation offering a ‘designation of homestead’ that they believe is deceptive to please call my office’s consumer hotline at 800-621-0508 and report it.”

Texas consumers can also always report suspicious or fraudulent activity by filing a complaint with the attorney general’s office online at texasattorneygeneral.gov.

The Homestead Designation Services Form