The U.S. federal government is now in the process of sending Economic Impact Payments or COVID-19 stimulus payments by direct deposit to millions of Americans who aren’t required to file a tax return, but who are still eligible to receive the $1,200 stimulus payment. The IRS' website at freefilefillableforms.com is being used to collect banking account information from these Americans. But, identity thieves can use stolen personally identifiable information to file for victims' Economic Impact Payments and have the stimulus payments sent to their bank accounts, instead of to the needy Americans who are mostly low-income workers, certain veterans, and individuals with disabilities. This scam would be something similar to tax refund scam, which is the #1 fraud faced by the U.S. Internal Revenue Service.

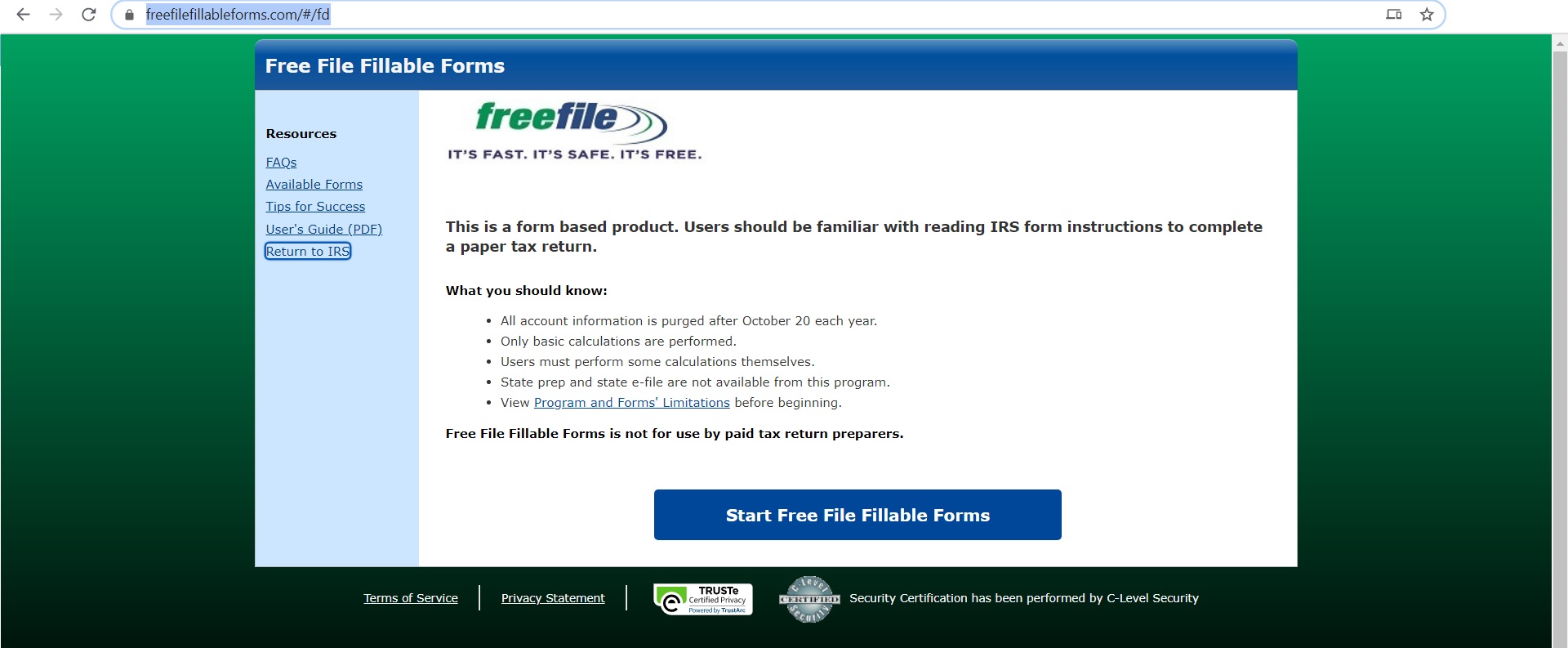

The FreeFileFillableForms Website

The possibility that fraudsters may intercept payments to these individuals seems very real, given the relatively lax identification requirements of this non-filer portal and the high incidence of tax refund fraud in years past. Each year, scam artists file phony tax refund requests on millions of Americans, regardless of whether or not the impersonated taxpayer is actually due a refund. In most cases, the victim only finds out when he or she goes to file their taxes and has the return rejected because it has already been filed by scammers.

In this case, fraudsters would simply need to identify the personal information for a pool of Americans who don’t normally file tax returns, which may well include a large number of people who are disabled, poor or simply do not have easy access to a computer or the Internet. Armed with this information, the scammers need only provide the target’s name, address, date of birth and Social Security number, and then supply their own bank account information to send the $1,200 payments to it.

According to a 2013 report, the Internal Revenue Service(IRS) continues to increase its efforts to identify and prevent fraudulent tax refunds from being issued as a result of identity theft. The report mentions that during 2012, the IRS prevented the issuance of $20 billion of fraudulent refunds, including $8 billion related to identity theft, compared with $14 billion in 2011. The IRS says it stopped more than $12 billion in fraudulent refunds from going to identity thieves in 2013. Hopefully, the IRS’ efforts will result in even better future results, which will help prevent thieves from stealing money from needy Americans in this Coronavirus COVID-19 global pandemic.