EIP Card at www.eipcard.com is not a scam. The government is sending some people Economic Impact Payment Cards if they qualified for a stimulus payment and the IRS couldn’t direct deposit the payment. Your Economic Impact Card will come in a plain envelope from 'Money Network Cardholder Services” along with important information about the card, instructions for activation, fees, and a note from the U.S. Treasury.

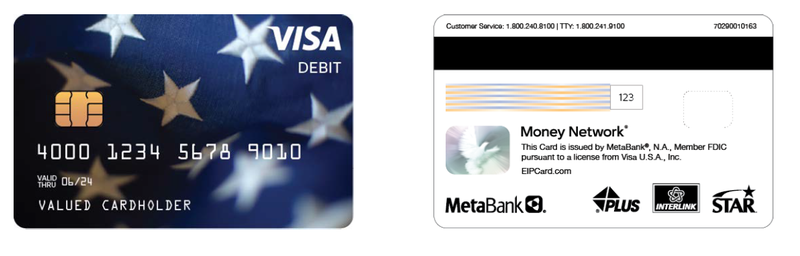

The card itself will have the words “VISA” and “DEBIT” on the front and the issuing bank, “MetaBank, N.A.”, on the back and should look like this:

How do I activate my card?

Before you can access your Economic Impact Payment, you will first need to activate your card, either online or by phone. You will receive only one card for your household and the primary cardholder must activate the card.

If you are the primary cardholder:

- Go to EIPCard.com or call 18002408100 (TTY: 1-800-241-9100)

- Provide your name, address, and social security number to validate your identity

- Create a 4-digit PIN so you can get cash at the ATM. If you forget your PIN, you can call customer service to get a new one

- Check the balance to know how much you received

Once you activate your card, you can start using your card immediately. There is no monthly or inactivity fee and your money does not expire. You do not need to pay this money back and do not have to pay taxes on this money.

How do I check my balance without paying a fee?

There are multiple ways you can check your balance conveniently 24/7 for free, including through push notification, text, or email:

- Online: visit EIPCard.com (account registration required)

- By Phone: call 1-800-240-8100 (TTY: 1.800.241.9100) and use the automated voice response system

- Mobile App: download the Money Network® Mobile App (account registration required)

Tip: If you typically check your card balance at the ATM, try to use one of the free ways above to avoid paying a balance inquiry fee.

How do I use my card to get cash without paying a fee?

There are several ways to get cash from your card without paying a fee.

- Use one of the In-Network AllPoint brand ATMs to withdraw cash. Use the ATM locator at EIPCard.com or Money Network® Mobile App to locate one near you. Limits may apply to the amount of cash you are able to withdraw at ATMs.

- Get cash-back at participating merchants, like grocery and convenience stores. If the merchant allows cash-back during a purchase, select “Debit” on the keypad, enter your 4-digit PIN, select “Yes” to get cash-back, and then enter the amount of cash you would like. Check the merchant’s policies on amount limits.

- Request a Money Network Check and cash it at select participating check cashing locations. Go to EIPCard.com to find the nearest participating check cashing locations. To avoid a fee, cash only Money Network Checks and only at participating check cashing locations. Limits may apply.

Tip: If you already have a bank or credit union account that you are comfortable using to access cash for free, you can also transfer money from your card to this personal account and then withdraw cash in the same way you normally would once it is available.

How do I transfer money from my card to a personal account without paying a fee?

To transfer your money to a personal account without a fee, you will need to log into your account at EIPCard.com to initiate a transfer.

- To transfer to a personal bank or credit union account, you will need to provide your routing and account number for your personal account at EIPcard.com .

- To transfer to an existing personal prepaid card, first check if your personal prepaid card accepts transfers by logging into your account or calling your card provider. If it does, provide the routing and account number for your personal prepaid card at EIPCard.com .

Tip: In many cases, peer-to-peer (P2P) apps—like Venmo or Zelle—will accept your Economic Impact Payment Card as a source of funding. Check with the P2P provider for specific instructions on if you can do this for free.

I would like to pay a bill (such as rent) that doesn’t allow payment with debit cards. How can I do this without paying a fee?

You can pay rent, bills, or other payments from your account using a Money Network Check without paying a fee.

To do this, you need to:

- Request a Money Network Check by calling customer service at 1-800-240-8100

- Check your balance to make sure you have enough funds to cover your payment

- When you receive the check, fill out the date, dollar amount, and name of who you are paying

- Activate your check by calling customer service at 1-800-240-8100 and following the instructions to enter the check number, digit, and amount, and record the issuer number and transaction number provided by the automated phone system

- Once you have successfully activated your check, the payment will be immediately deducted from your account balance and you can send your payment for your rent or other bill

Tip: If you occasionally pay a bill with a money order, consider using a Money Network Check to pay your bill instead to avoid paying a money order fee.

I am not familiar with prepaid debit cards. What is important to know about using this card?

The Economic Impact Payment Card is a VISA prepaid debit card. The government has loaded your Economic Impact Payment onto the card for you. You do not need to pay this money back and you will not be taxed on this money. Once activated, your money is safe on this card and is eligible for FDIC insurance. Be sure to immediately report if your card is lost or stolen.

If you have had a checking account debit card or credit card before, this card may be a little different. First, this card is not linked to any bank or credit union account and will not have any impact on your credit score or help you build your credit. You cannot overdraft or spend more than what has been loaded on the card. If you don’t have enough money to cover a purchase, the transaction may be declined or partially authorized. If this happens, you may be asked to use another form of payment to pay the full or remaining amount if you want to complete the transaction.

You can get cash, request a check, or make a purchase anywhere VISA debit cards are accepted. Each time you use your card, the amount will be deducted from your balance until you use all your funds. You will not be able to load your own money on this card and your money will not expire. If you do not use all your money before the expiration date printed on the card, you can call customer service to request a refund check for the remaining balance.

Tip: If you use this card to pay for gas, give your card to the attendant to pre-pay for gas rather than paying at the pump to avoid a pre-authorization. A pre-authorization puts a temporarily hold on your money that could be greater than the transaction amount and may take up to 10 business days to be released back to you. Paying the attendant to pre-pay for gas can help you avoid placing a hold on your money so that you have access to your money if you need it.

What do I do if my card is misplaced, lost, or stolen?

If you think you have misplaced your card, go to EIPCard.com and lock your card to prevent unauthorized transactions or ATM withdrawals while you look for it.

If your card is permanently lost or stolen, call customer service at 1.800.240.8100 (TTY: 1.800.241.9100) to report your lost or stolen card immediately. Your card will be deactivated so nobody can use it. There is a $7.50 fee to order a new replacement card ($17.00 if you need it expedited).

Where can I find the fees for optional services?

While most transactions are free, some fees may apply.

Check your cardholder agreement and other important information material that came in the envelope with your card or at EIPCard.com . This will include a full schedule of fees and services as well as more details about your card.